Fashion’s Reliance on the Chinese Luxury Market

For most of us, we experience fashion through the lens of consumers. We look at the fits, the Instagram posts, and the trends list, waiting to figure out our next purchase. But there is another side of fashion, one that we seldom discuss; the business of fashion. No, this is not an article about how the publication founded by Imran Ahmed is run, but, we will care less about design for this reality-check and instead look at how fashion is doing in business terms.

Fashion is a popular choice for investors, and in a digital world, it’s so easy to fall into the trappings of the social media guise. These days trends come thick and fast, and PR tricks can convince us that a brand’s profitability is through the roof. However, we all know that social media is a great-illusion maker, and pretty pictures and likes on Instagram don’t always translate into real-world sales. So, as we wrap up the first quarter of 2022, let’s take a look at how things are stacking up in the business of fashion.

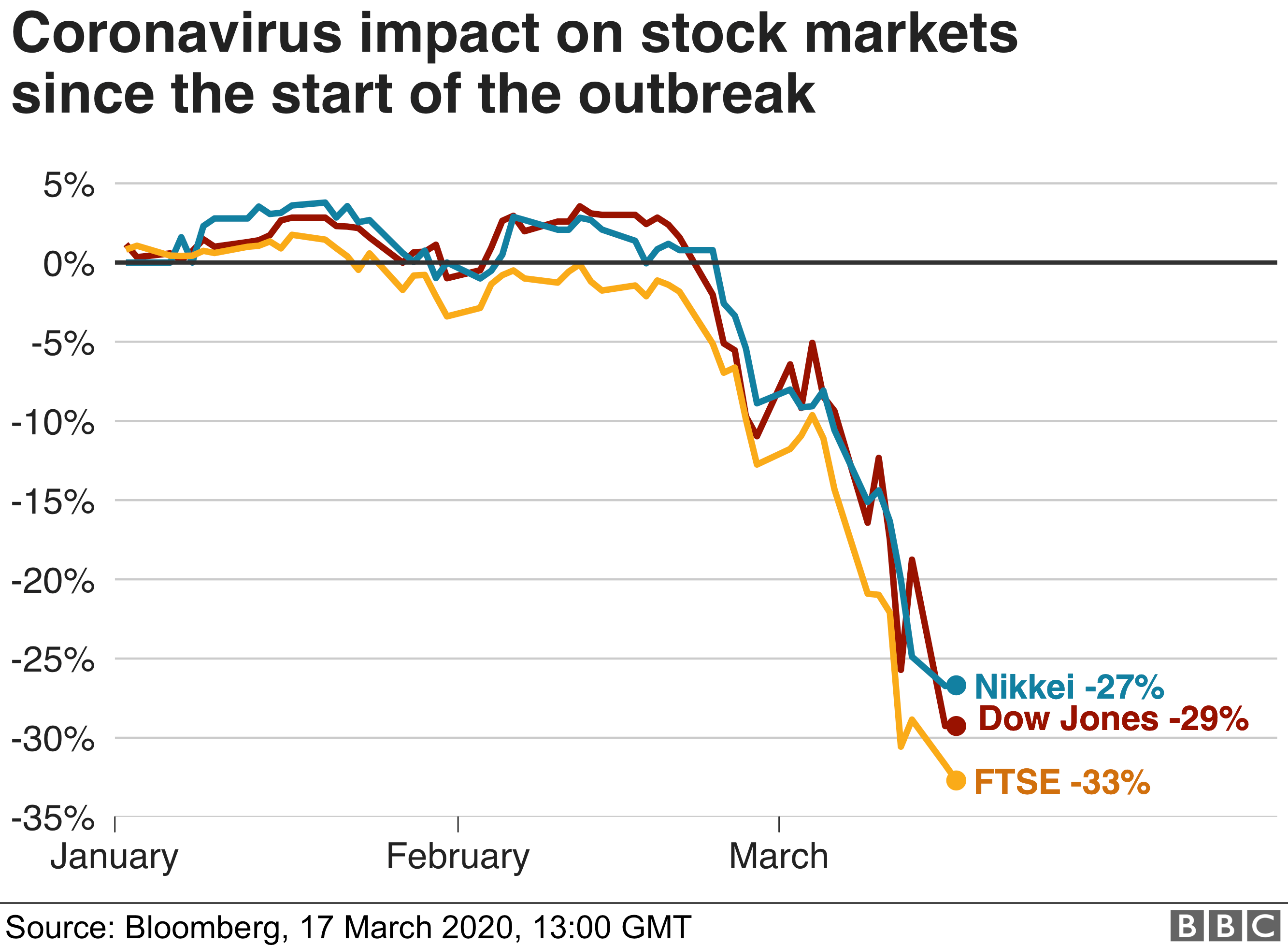

Firstly, we have to say that it has been a tough go for several retail businesses. The sector was hit hard during the Coronavirus pandemic (which is still ongoing, in case you hadn’t noticed) with disruptions to supply chains, changes in consumer trends and an overall shift in the global economic status quo. Despite all this, luxury companies found a way to remain somewhat profitable when consumer confidence was at a low, and as of writing this, things remain decidedly mixed.

Clothing is a basic staple, and historically apparel has not been a high growth segment of the global economy. While many of our favourite designer brands are European, it is the Chinese market and customers that shape consumer preferences. This is why fashion makers are looking to the East’s appetite for luxury to offset the shortcomings and losses left by the pandemic. For LVMH, the world’s leading luxury goods group, Asia is the group’s single biggest market, accounting for 44% of total revenue in 2021. Against the backdrop of a gradual recovery from the global pandemic, luxury European conglomerates like LVMH and its closest rival Kering (owner of brands like Balenciaga and Gucci) are red hot. For 2021, Kering reported strong financials with revenues up by +34% from the previous year – again thanks to sales driven by the Chinese Market. But, it hasn’t been happy going for everybody.

Take luxury goods brand Burberry. Based in the U.K, Burberry is the hallmark of Britain’s luxury fashion. Headed by the great Riccardo Tisci, Burberry has been trying to reinvigorate itself for a while now, with off the calendar shows, celebrity endorsements, and a recent collaboration with streetwear behemoth Supreme. However, when taking a peek behind the beige Scottish tartan printed curtains, Burberry Group’s share price has had significant negative movement since the stock market crash of February 2020, and forecasts have it falling further. While I’m no economist, it’s clear that many factors contribute to Burberry’s low share price. For example, Burberry lags behind its competitors when it comes to retail sales performance, and, for all his design capability, Tisci’s appointment has not brought Burberry back from the dead as he did with Givenchy. But with a new CEO, who has a history of turning around major brands, Burberry’s times of trouble may be coming to an end.

Still facing significant challenges amid supply chain issues, spotty demand as customers turn to the second-hand market, and economic pressures, companies are still trying to find their feet. Buoyed by the insatiable need for luxury fashion in China, brands are adapting to a shift in customer needs and investing in digital strategies that are forecasted to be the nexus for growth in the coming years.

But it’s not all doom and gloom – the demand for luxury goods is not going to halt anytime soon. America alone expects its consumer will spend around $360 billion on designer goods by the end of 2022. Although Europe lags, the return of international tourism will be a much-needed help to bolster sales.

However, as national lockdowns take place all over China, it remains to be seen what the outcome will be for a fashion industry that is heavily reliant on the Chinese market.

Discover more from GUAP’s Fashion section here

![ZINO VINCI’S ‘FILTHY & DISGUSTING’EP BRINGS YOU TO THE CORE OF THE ARTIST [@ZinoVinci]](https://guap.co/wp-content/uploads/2023/10/Zino-4.jpg)